The dream of running a restaurant may include curating the perfect space for joyful gatherings and magical evenings of great food and drink, with you playing the gracious host, who just happens to profit off the whole happy affair.

But the reality of running a restaurant is more like living life in the eye of a storm. The daily barrage of customer demands, managing cooks and wait staff, mounting stress from the 24/7 nature of the job and staying ahead of the competition—all on razor-thin margins.

There’s a lot to stay on top of in the pursuit of profitability. Perhaps you’ve relied on business techniques such as sales promotions, honing your marketing strategy, or nailing an effective advertising plan. These customer-facing methods are helpful, but it’s also important to look within. It’s less splashy, but absolutely essential to the health of your restaurant.

Today, we’re going to focus on one critical component that can make the difference between whether your restaurant thrives or shuts down—managing your food cost percentage.

Your food cost percentage directly impacts your bottom line.

What is it? Simply put, it calculates the cost of your ingredients as a percentage of food sales.

Especially for restaurants operating on barely-there profits, any variation in the cost of your ingredients or mismanagement of inventory can deeply impact your margins.

1. Calculate ideal food cost

Most restaurants work with a food cost percentage of roughly 20 to 30 percent. But the real comparison game you want to play is comparing your actual food cost with your ideal food cost.

Your ideal food cost will be different from your actual food cost because it won’t account for variances that occur in the real world, such as wasted inventory, serving inconsistent portions, theft and fluctuations in market prices. And that’s the point—this benchmark will help you identify where your actual food cost has gone astray.

Here’s the formula for calculating your ideal food cost.

Total cost of ingredients used in all plates ÷ total sales = Ideal food cost

So let’s break this formula down.

Total cost of ingredients used in all plates. You arrive at this number by calculating exactly what ingredients, and how much of each ingredient, goes into each menu item.

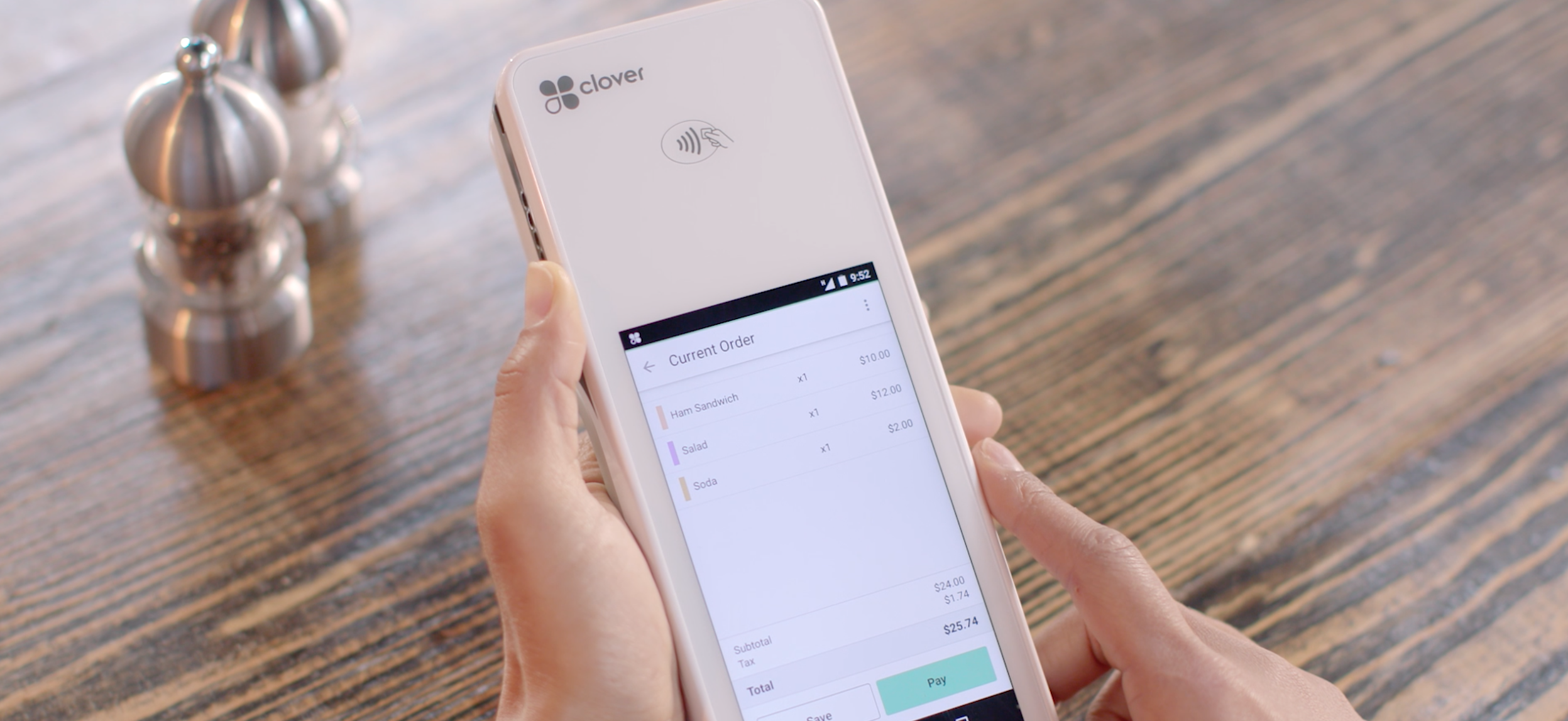

For the sake of simplicity, let’s say your restaurant is a food truck selling only chips and guacamole. An order of chips and guacamole would include the per-plate cost of the chips, avocado, onion, garlic, jalapeno, cilantro, salt and lime. Then you’d multiply this cost by the number of these items sold in this period. You can pull this information using Clover Insights (from the popular Point of Sale we offer).

And if you’re operating a restaurant with a full menu, you would do this for every menu item and add everything up for your total cost of ingredients used in all plates.

Total sales. Multiply the sales prices of each dish by the number of each dish sold.

If we look simply at the chips and guacamole food truck example, the ideal food cost is calculated as follows:

Per-plate cost of ingredients for chips and guacamole: $1

Number of units sold this week: 100

Cost of ingredients: $1 x 100 = $100

Per-plate sales price for chips and guacamole: $4

Number of units sold this week: 100

Food sales: $4 x 100 = $400

Total cost of ingredients used in all plates ÷ total food sales = Ideal food costs

100 ÷ 400 = 0.25

Your ideal food cost percentage is 25%.

Doing this calculation manually for your entire menu is cumbersome, but with the right inventory and sales software, you can have this calculation run automatically.

2. Calculate actual food cost

Now it’s time to calculate your actual food cost percentage.

You’ll use this formula:

(Beginning inventory + Purchases – Ending inventory) ÷ Food sales = Actual food cost

Let’s stick to the same one week time period. Again, let’s break this formula down.

Beginning inventory. At the start of the week you’ll calculate the total cost of all of your inventory.

Purchases. Calculate the cost of all new inventory purchased that week.

Ending inventory. At the end of the week, calculate the cost of all of your remaining inventory

Food sales. At the end of the week, add up your total food sales generated during this period.

Going back to our chips and guacamole food truck example, let’s say we came up with the following numbers:

Beginning inventory: $60

Purchases: $80

Ending Inventory: $20

Food sales: $400

(Beginning inventory + Purchases – Ending inventory) ÷ Food sales = Actual food cost

($60 + $80 – $20) ÷ $400

$120 ÷ $400 = 0.30

Your actual food cost percentage is 30%.

3. Compare actual cost vs. ideal cost

Now that you have both your ideal cost and actual cost figures, compare the two. Using our chips and guacamole food truck example, there’s a discrepancy. Our ideal food cost percentage is 25%, compared with our actual food cost percentage of 30%, which tells us that something is amiss, and gives us reason to investigate further.

4. Investigate discrepancies

Many reasons could explain the actual vs. ideal cost discrepancy and each has its own solution.

- You may discover that there’s been a change in the cost of certain ingredients. Consider updating the price of your menu items to account for this increase. Buying seasonal items can also help reign in your costs. This may prompt you to redesign your menu and the ingredients you use on a seasonal basis.

- If you realize that employees are dishing up inconsistent portions, perhaps additional employee training and an emphasis on proper measurements is in order.

- And of course, if your investigation leads you to discover employee theft, you know what to do.

- Pay attention to the dishes that come back to the kitchen at the end of the meal. If there is still a lot of food remaining on the plate, this is wasted inventory. Reduce your portion sizes.

- Use Insights to see which menu items sell and which do not. Consider removing items that aren’t selling.

At the end of the day, having these two calculations offer you critical insight into your restaurant’s profitability and help you pinpoint exactly where you can improve.

As a restaurant owner, your work is nonstop as you juggle managing employees, keeping customers happy and implementing strategies to expand your business.

But remember that despite the nonstop activity on the restaurant floor, it’s crucial that you take time to pause and examine what’s happening behind the scenes. By keeping an eye on your inventory and food cost metrics and making adjustments to prices, portions, and other factors based on the numbers you see, you’ll be on your way toward increased profitability.

Interested in a Clover Point of Sale that can help you tabulate all the above? What if we could eliminate ALL of YOUR fees? How about getting your money next day, and qualifying for free equipment? Yeah, it’s a reality! We can do it all. And more and more business owners are doing it…. why pay fees for your business to accept credit cards! It’s 100% available in YOUR AREA, current, and easy. Send us a message here, on Facebook or at BuyLocalBG@Gmail.com.